2025 has opened with a complex mix of optimism and caution across global markets. While inflation is cooling in some regions, central banks remain watchful. Stock markets are adjusting to new realities, and investors are closely watching everything from tech sector rebounds to geopolitical risks.

Here’s a breakdown of the key economic forces shaping this year—and what they mean for businesses and individuals alike.

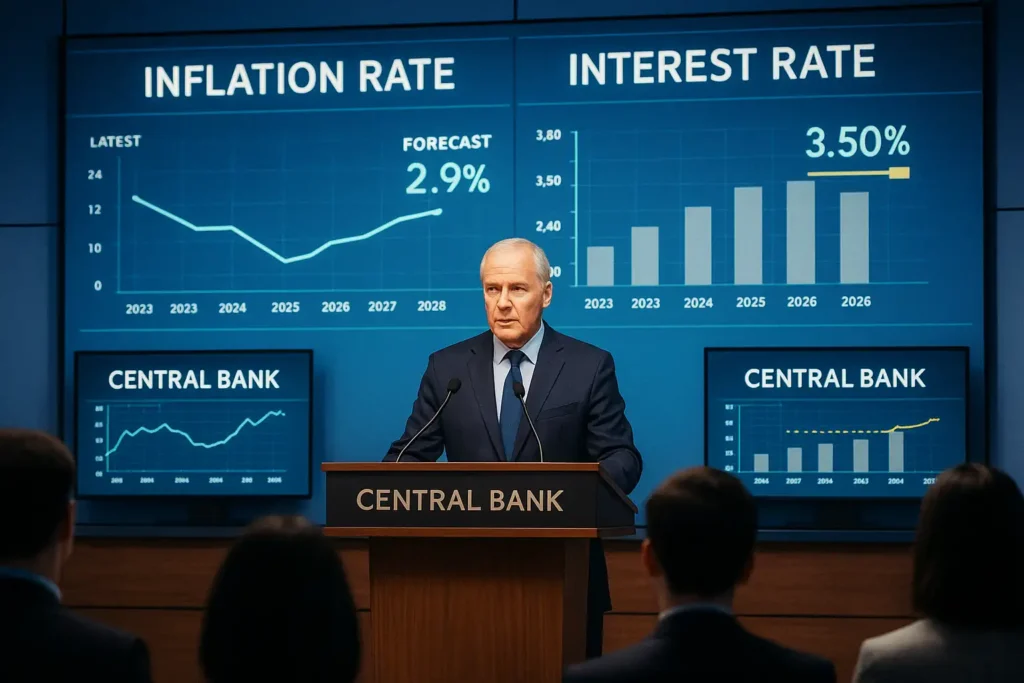

Inflation slows, but policy remains tight

In many major economies, inflation is no longer at its 2022–2023 peak. However, central banks aren’t declaring victory just yet. The U.S. Federal Reserve and the European Central Bank are signaling that interest rates may remain elevated longer than some expected.

Key points:

- Rate cuts may come later in the year—but only if inflation data supports it

- Core inflation (excluding food and energy) remains a concern

- Borrowing costs are still high for businesses and households

For now, stability is taking priority over growth, especially in developed markets.

Stock markets searching for direction

Equity markets have seen a mix of rebounds and resets. The tech-heavy Nasdaq is recovering from previous losses, driven by renewed excitement around AI and cloud infrastructure. Meanwhile, energy and utilities remain steady amid global focus on renewables.

What’s happening:

- Investors favor companies with strong cash flow and efficiency

- IPO activity is still muted, though some high-profile listings are on the radar

- Emerging tech sectors (AI chips, green computing) are gaining traction

Volatility is expected to persist through Q2, especially as earnings season unfolds.

Energy markets stabilize—but remain sensitive

After dramatic swings in previous years, oil and gas prices have found a more predictable range in early 2025. That said, they remain highly sensitive to geopolitical developments and supply chain constraints.

Key observations:

- Ongoing tension in key producing regions could impact supply

- Green energy investments are growing faster than expected

- Governments are maintaining strategic reserves at higher levels

The energy transition is playing a long game, but it’s clearly influencing capital flows and infrastructure decisions.

Emerging markets show pockets of strength

Countries in Southeast Asia, Latin America, and parts of Africa are drawing attention for their resilience and growth. Lower debt levels, strong demographics, and digital infrastructure investments are driving confidence.

Markets to watch:

- Vietnam and Indonesia in Asia

- Kenya and Nigeria in Africa

- Brazil and Colombia in Latin America

Investors are also interested in local payment systems and cross-border financial solutions—a sign of maturing digital economies.

The rise of digital currencies and financial tech

Central bank digital currencies (CBDCs) are now in live pilot phases in over 20 countries. Meanwhile, private financial platforms are offering faster, more flexible solutions for cross-border transactions.

One of the solutions gaining momentum in this space is dns-pay.com, which provides secure and efficient international payment tools tailored for businesses operating across borders. Its growing adoption highlights the need for streamlined alternatives to traditional banking systems.

Why it matters:

- Governments are testing digital currencies for security and efficiency

- Small and mid-sized businesses are adopting fintech tools at scale

- The line between banking and technology continues to blur

This could be a defining year for how value moves globally—and which platforms become central to that shift.

Global risk factors to keep in view

As always, the economy doesn’t move in a straight line. Key risks include:

- Political elections and trade tensions

- Supply chain disruptions tied to extreme weather

- Debt levels in both corporate and public sectors

- Market reactions to central bank policy shifts

Preparedness, adaptability, and good data will be the biggest assets for decision-makers in 2025.

Navigating a dynamic year ahead

The economic landscape in 2025 is far from dull. While challenges remain, so do opportunities—for businesses, investors, and governments. The key is staying informed and agile as conditions evolve.

Whether you’re managing a portfolio, launching a startup, or making household decisions, the months ahead will reward those who are watching the signals—and responding in real time.